Virtual Accounts Overview

Streamline your business payments with unique, system-generated virtual accounts. Automate payment reconciliation, enhance security, and organize transactions for individual customers or specific use cases. Learn how virtual accounts work.

Virtual accounts are unique, system-generated bank account numbers that facilitate secure and organized payment processing between businesses and their customers. Virtual accounts are purpose-specific bank accounts that act as intermediaries in financial transactions. They can be configured for one-time use or ongoing payment relationships, providing flexibility for different business scenarios.

Virtual accounts are created and assigned to customers or transactions according to your business logic. When a customer needs to make a payment, they transfer funds to the virtual account you've provided them. Our platform automatically matches incoming funds to the correct virtual account and sends webhooks to your system in real-time, completing the payment cycle seamlessly.

Supported Countries & Coverage

Virtual account processing is available in the following countries:

Use Cases

Virtual accounts excel in business-to-business scenarios where transaction amounts are significant and proper documentation is crucial. Each virtual account can be associated with a specific invoice, project, or client, creating an automatic audit trail that simplifies reconciliation. Large corporations use virtual accounts to manage payments from multiple departments or subsidiaries while maintaining clear financial separation.

Digital wallets and fintech platforms use virtual accounts as core banking infrastructure, providing each user with unique account numbers for deposits and withdrawals without traditional banking overhead. This enables 24/7 operations, instant account provisioning, and scalable management of millions of accounts while maintaining bank-grade security and regulatory compliance through API-driven architecture.

For international transactions, virtual accounts denominated in local currencies help businesses avoid foreign exchange complications and reduce cross-border payment fees. Customers pay in their local currency to a local virtual account, while merchants receive funds in their preferred currency.

For remittances, they facilitate cross-border transfers with better exchange rates, enabling recipients to access funds through multiple channels while providing complete transaction tracking and regulatory compliance automation.

How It Works

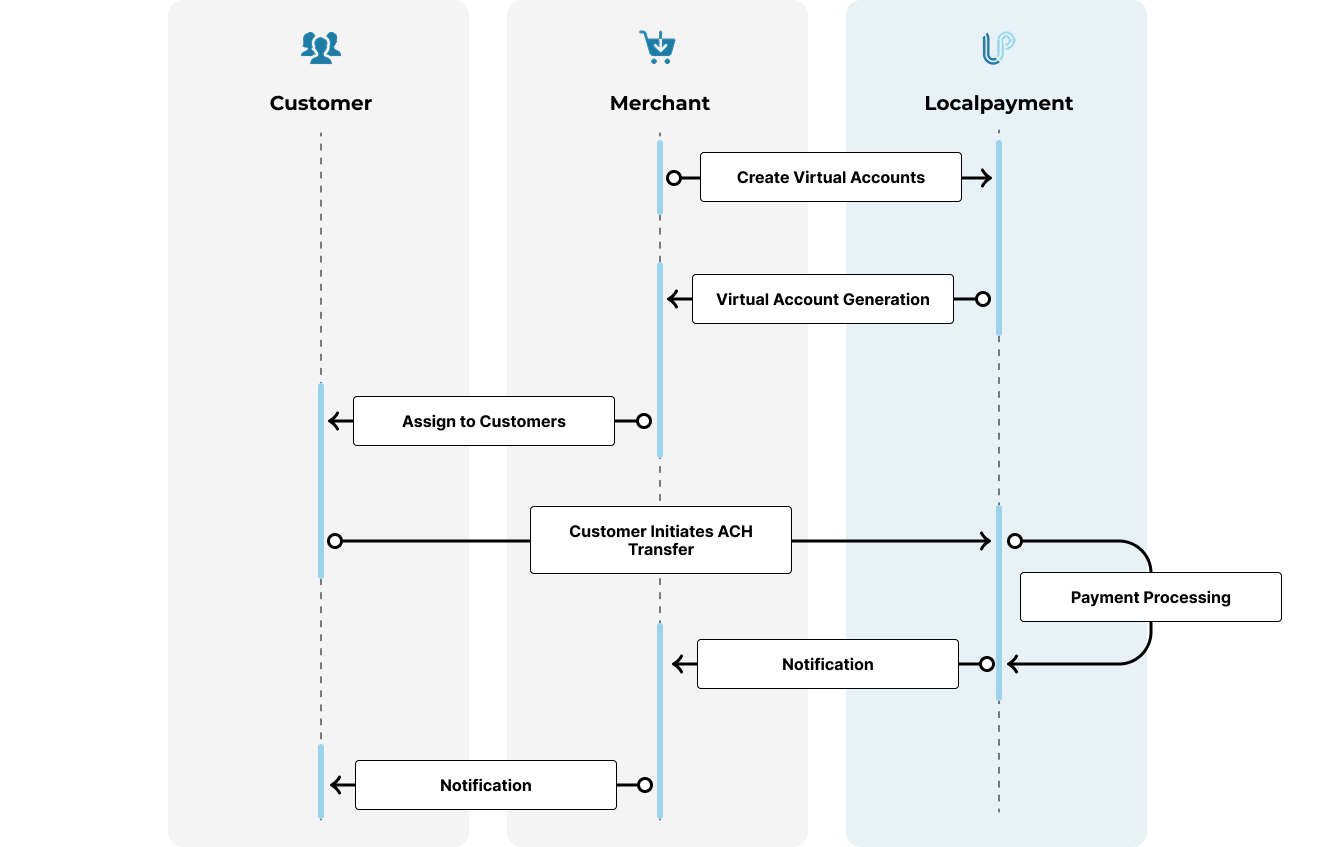

The process of using virtual accounts through Localpayment involves the following steps:

- Create Virtual Accounts: The merchant initiates the process by creating virtual accounts through Localpayment. Each virtual account is uniquely generated to facilitate individual tracking.

- Virtual Account Generation: Localpayment automatically generates a unique virtual account and sends the account details.

- Assign to Customers: The merchant is responsible for mapping virtual accounts to their internal customer or order records. This enables accurate payment attribution and reconciliation on their end, separate from the platform's fund handling and settlement processes.

- Customer Initiates ACH Transfer: Customers perform local ACH bank transfers, directing funds to their assigned virtual account numbers. This method ensures that payments are routed correctly without the need for additional identifiers.

- Real-Time Reconciliation: Upon receipt, payments are automatically reconciled in real-time. Localpayment's system performs automatic matching of incoming funds to the designated virtual accounts, with immediate updates to transaction records.

- Notification: Merchants receive instant notifications for successful payments. These alerts confirm transactions and provide key details for efficient financial management.

Prerequisites

Before creating your first virtual account, ensure you have completed the following essential steps:

Implementation Guide

Implementing virtual accounts for payment processing not only simplifies transactions but also enhances security and operational efficiency. Below are some of the latest best practices and trends to consider when implementing virtual accounts on your platform.

Generate unique virtual account numbers via API for individual customers or transactions.

Create virtual accounts without API integration using dashboard tools or batch uploads. Ideal for one-time setups.

Retrieve current status and details of any virtual account. Monitor active accounts and verify account configuration in real-time.

Temporarily suspend or reactivate virtual accounts without deleting them. Perfect for pausing payments during disputes or customer service cases while preserving account data.

Permanently deactivate a virtual account. This prevents all future payments to it but retains its full history. The action is irreversible. Use for accounts no longer needed; create a new one to resume operations.

Configure webhooks to get instant payment confirmations when customers transfer funds. Automatically update order statuses and trigger fulfillment processes upon successful payments.

Add memorable aliases to virtual accounts for easier customer identification. Simplify payment references while maintaining unique account numbers.

Learn how Virtual Accounts can be used (Per Transaction, Per Submerchant, Per User, Omnibus) and how to reconcile incoming payments programmatically.

Virtual Account Operations

Once a virtual account is successfully created and active, various operational workflows can be managed throughout its lifecycle to optimize payment collection and customer experience. The available operations depend on the account status, transaction requirements, and specific business needs. Here's an overview of the key operational capabilities:

| Country | Status | Enable / Disable | Delete | Alias | Webhooks |

|---|---|---|---|---|---|

| Argentina | ✔ | ✔ | ✔ | — | ✔ |

| Brazil | ✔ | ✔ | ✔ | ✔ | ✔ |

| Chile | ✔ | — | — | — | ✔ |

| Mexico (SPEI) | ✔ | ✔ | ✔ | — | ✔ |

| Mexico (TEF) | ✔ | — | ✔ | — | ✔ |

| Mexico (SPID) | ✔ | — | — | — | ✔ |

| Peru | ✔ | ✔ | — | — | ✔ |

Updated 26 days ago